| |

|

|

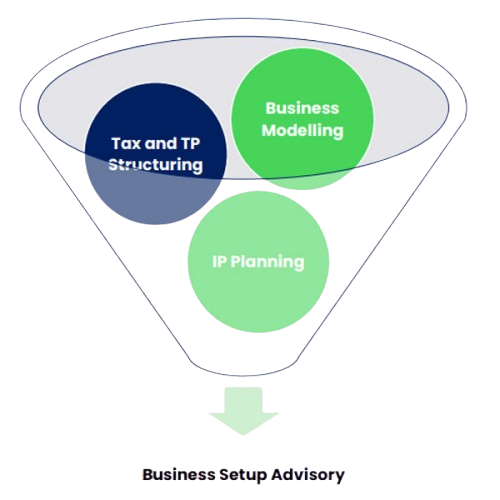

Setup & Structuring - Advisory That Sets the Foundation

- Designing tax-efficient structures, legal entity setup, and incorporation strategies across jurisdictions

- Modelling intercompany Transfer Pricing, Corporate Tax, and VAT frameworks with clear policy positions

- Structuring IP, functions, risks, and assets aligned with DEMPE analysis and legal ownership

- Planning end-to-end regulatory footprints including CT, VAT, WHT, Customs, ESR, and licensing requirements

- Supporting accounting, audit, and financial reporting considerations in greenfield setups

- Facilitating incorporation, compliance system setup, and statutory registrations through trusted partner network

Poor structuring

leads to costly

corrections

Early TP

alignment avoids

audit exposure

Strategic setup

enhances

investor

confidence

Laying the Groundwork for Global Growth

Growth & Scaling - Implementation Support That Keeps Pace

- TP documentation (Master File, Local File, CbCR), ESR audit trails, and local regulatory reporting

- Real-time TP policy monitoring and operational calibration for dynamic business models

- CT & VAT return preparation, reconciliation, and filing enablement through partner ecosystem

- Advisory & Representation on Safe Harbour, Advance Pricing Agreements (APA), and advance Corporate Tax rulings

- Diagnostic health checks across TP, CT, VAT, ESR, and compliance posture

- Bookkeeping, payroll, and accounting enablement, integrated with compliance frameworks

- Process automation and tech-enabled dashboards for compliance tracking and alerts

Expansion Without Borders. Compliance Without Compromise.

Cross-Border Expansion - Advisory & Execution for Global Moves

- Cross-jurisdiction TP structuring and global CT planning

- Pillar Two readiness, GloBE modelling, and ESR reviews

- POEM/PE/CFC risk mitigation and workforce deployment strategy

- Intra-group service cross-charges, IP licensing, and financial arrangements

- Coordinated multi-country documentation & filing enablement

- Customs, VAT registration mapping, and indirect tax review (with local partners)

- Local GAAP and financial reporting guidance for new jurisdictions

Coordinated Global Execution. Built for Expansion.

Intra-group

financing and

shared

services

Substance and

people

functions

Compliance Support - Sustain, Defend, Optimize

- Cross-jurisdiction TP structuring, global Corporate Tax planning, and entity alignment

- Pillar Two readiness, Transitional safe harbour review, GloBE ETR modelling, and ESR compliance strategy

- PE/POEM/CFC risk mitigation, workforce deployment, and dual presence structuring

- Intra-group service charge models, IP licensing, and financial support arrangements

- Coordinated multi-country documentation, local filing enablement, and treaty positions

- Customs valuation advisory, VAT registration nexus, and indirect tax mapping (via partners)

- Guidance on local GAAP, financial reporting, and audit preparedness in new markets

- Overlay support on valuation, opening balance sheets, and regulatory licensing (as applicable)

Defensible Compliance. Continuous Readiness.

Exit or Reinvestment - Prepare, Repatriate, Reimagine

- Repatriation planning and cross-border CT strategy

- M&A transaction support and TP due diligence

- Valuations for IP transfers, business exits, and restructuring

- Support for spin-offs, entity liquidation, capital reduction, and tax base resets

- Regulatory clearance, Forex Regulations advisory, and cross-border remittance structuring (via partners)

- Post-deal compliance transformation across Corporate Tax, Transfer Pricing, VAT, ESR, and financial disclosures

- Shareholder exit planning and structuring of earn-outs (via legal/valuation partners)

Strategic Support Through Critical Transitions

M&A and

Transaction

support

Repatriation and Reinvestment

IP and

Business

Valuations

|

|

|

|

|